Venture and Pre-IPO Accessible to All

Invest in pre-vetted private companies at both early and late stages. Some available for as little as $100.

Choose a Company

Create an account and get access to unique deals in early rounds, Pre-IPOs and purchase IPO shares without a lock-up period.

Private investments are highly risky, illiquid and may result in total loss of capital.

0000

Launched in Launched in

0000 +

Investors

$ 00 M +

Invested Investments made

000 +

Countries Countries supported

Our simple process to start investing

Sign up and verify your account in 10 minutes. We'll tailor recommendations just for you.

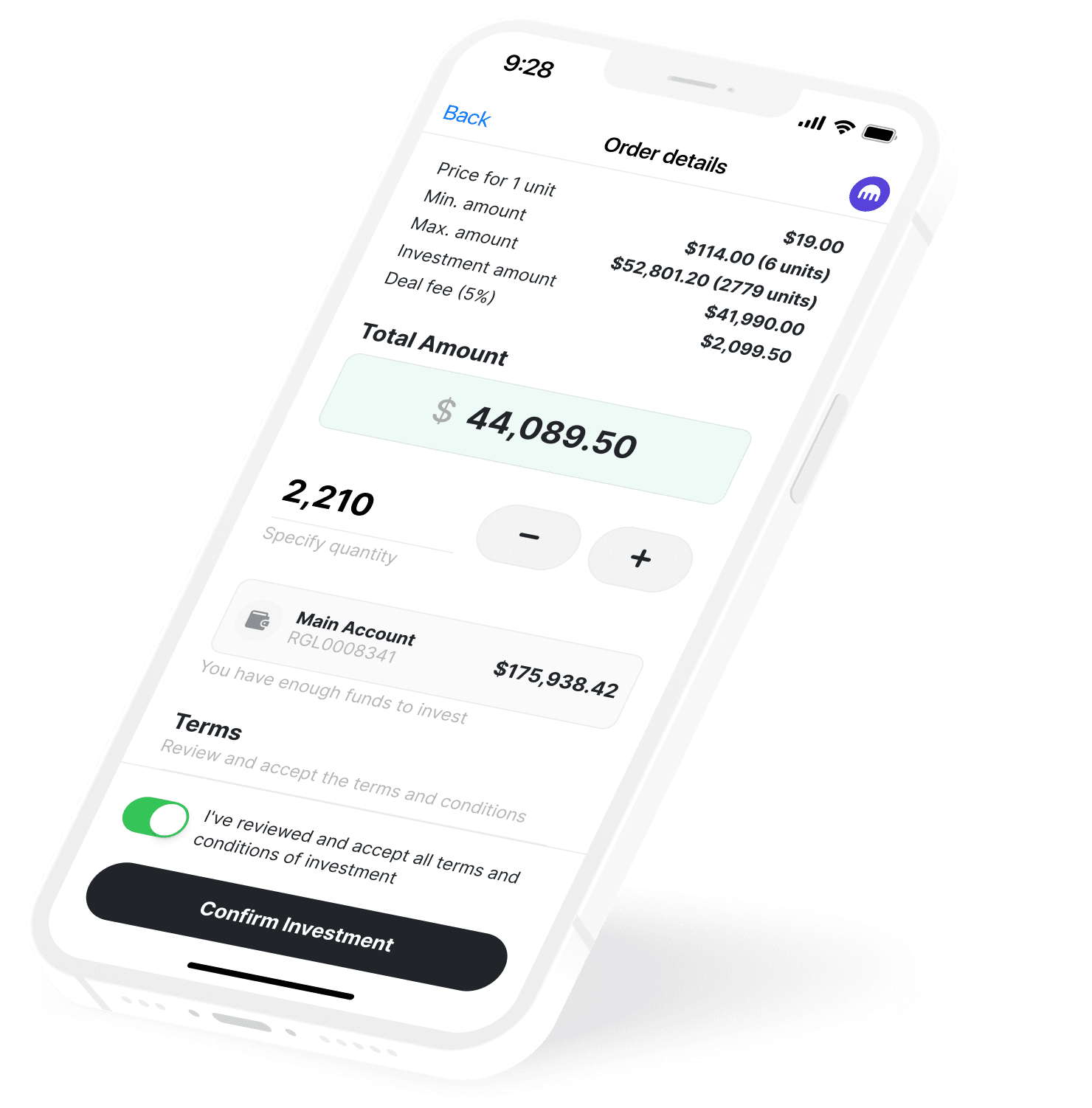

Explore investment opportunities online. Invest with just 2 clicks in what you like, starting from as little as $100.

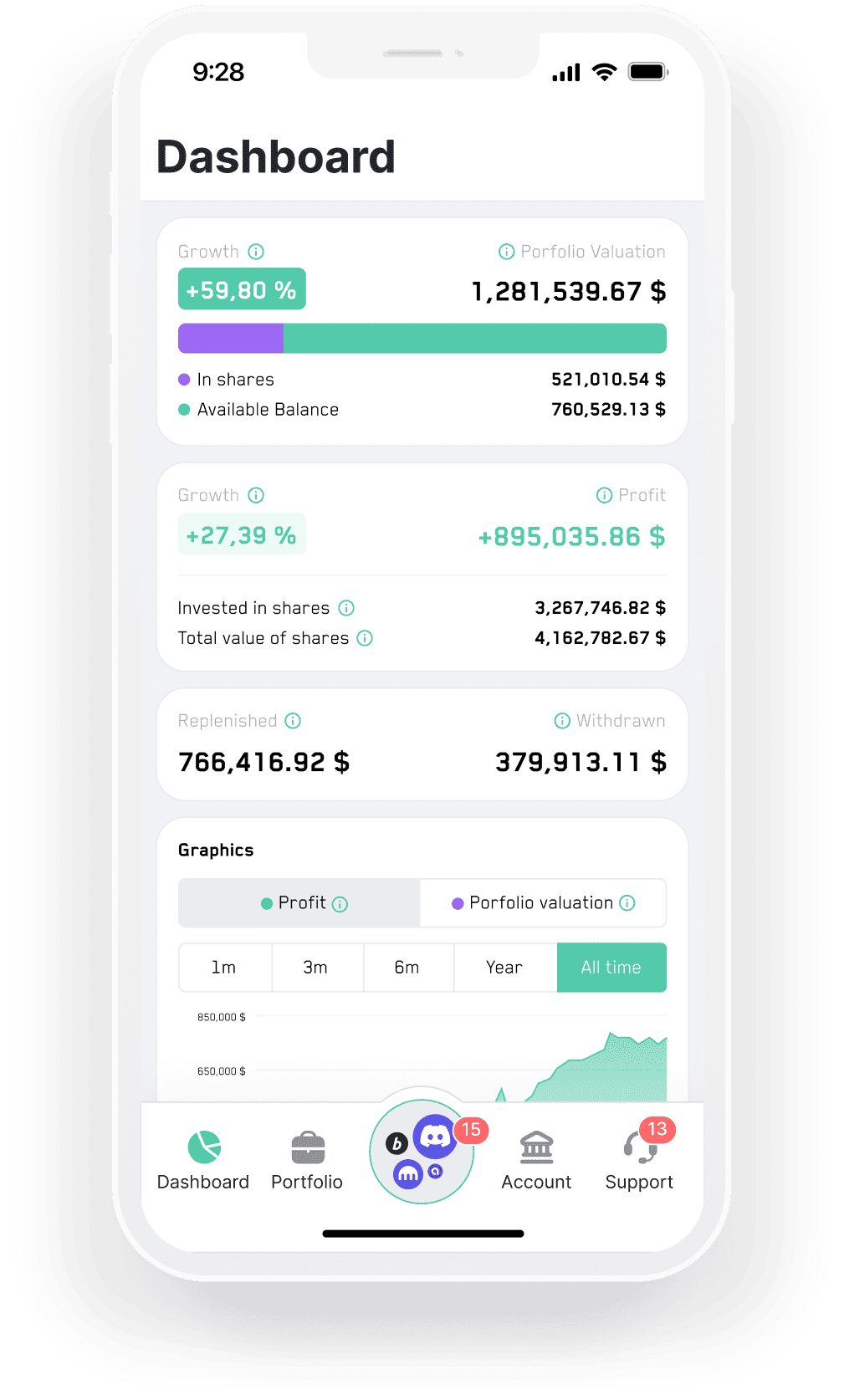

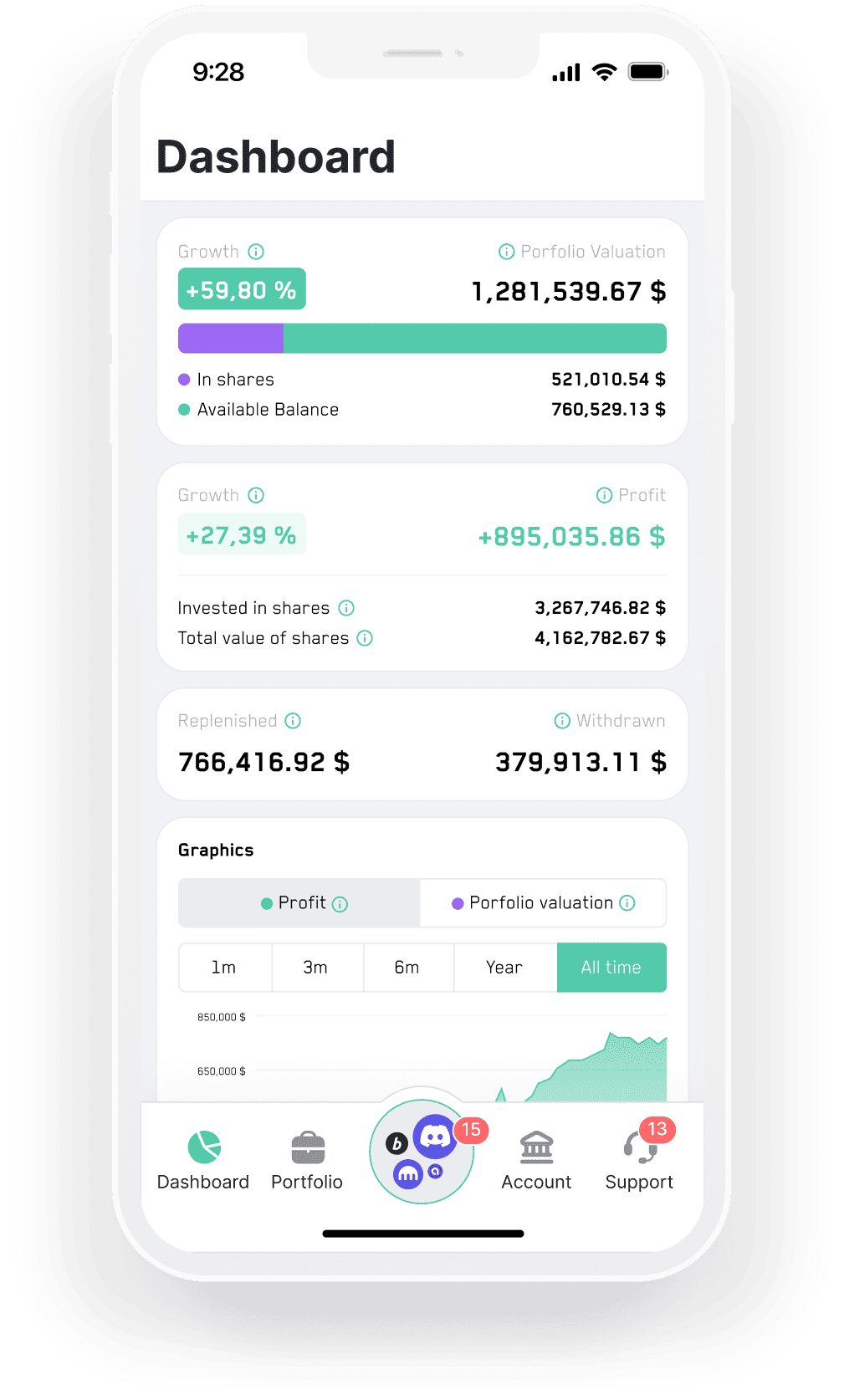

Track your results in the app and receive automatic updates on stored transaction documents in your portfolio.

Regolith was created to empower everyone with the opportunity to invest and build wealth through smart investments

Invest in pre-vetted private companies at both early and late stages. Some available for as little as $100.

Choose a Company

Receive dividends every two weeks by investing in Funds covering commodities, Real Estate, Stocks, and Digital currencies

Choose a Fund

Invest in a $1.3 trillion market with a yearly growth rate of +48% through a crypto fund with dividend yield

Invest in Crypto

Receive dividends every two weeks by investing in Funds covering commodities, Real Estate, Stocks, and Digital currencies

Explore further

Drawing on our investment experience since 2016, we leverage our knowledge and connections to uncover deals with the highest investment potential for you.

Goods and Raw Materials Arbitrage

Dubai Car Rental Fund

Cryptocurrency exchange, bank and wallet

Cryptocurrency wallet

Video, voice & text multichat

Social Data Analysis

24/7 yacht booking on your phone

WEB 3.0 social network

Platform for trading tokens

Spacecraft manufacturing

Profitable Real Estate in Dubai

Invest business club and сrypto fund

E-sign, video & chat messenger

Game and Software Developer

Manage your investments on your terms. Anytime, from anywhere in the world.

Accessible from any device (Web, iOS, Android)

Verification in just 5 minutes

Purchase an asset in just 2 clicks

Exclusive deals from $100 to $500,000

Legal documents and analytical reports

Metrics and charts for each transaction

Personal manager for clients from $100,000

Support service 7 days a week

Our history

Diversification and investments in alternative markets are crucial aspects of building long-term wealth. However, such tools are often inaccessible or restricted for private investors. Purchasing shares in private companies and PreIPO deals, meeting high initial requirements for real estate investments, and executing profitable transactions typically involve extensive legal work, substantial time, and networking.

In 2021, we established the private investment structure, Regolith, allowing direct trading on U.S. financial markets. Legally and without intermediaries, you can invest in financial opportunities and derivatives on the American market, engaging in various types of transactions such as Pre-IPO, IPO, Stock Market, and more alongside Regolith. Additionally, we've secured participation in financial deals and operations in collaboration with major banking institutions and underwriters.

Investing in startups and various private market ventures, commodities, and cryptocurrencies comes with inherent risks. We want to help you determine if private market investing is the right fit for you.

Submit your request for a consultation with our investor relations team. They'll make time to educate you and address your questions without any sales pressure. Rest assured, we are here to assist you.

One of the main advantages of the marketplace is the ability to purchase a volume of a trade starting from as low as $100 or even one share. This allows every user to invest in exclusive offers with just a few clicks.

Frequently asked questions

Join over 7000 investors who are already building a portfolio of unique deals with us. Don't wait, join now!